- Save tax with a hotel subscription*:

Use a hotel as a second home and save tax on your company car - Flexible secondary accommodation:

No long rental contracts thanks to flexible hotel subscription term – can be terminated monthly - Simplify your tax return*:

For the MyFlexHome hotel subscription, you receive an annual overview of all nights booked, which significantly simplifies your tax return

How to use a hotel subscription as a second home to save tax:

If you use a company car, the distance from your second home to your place of work is used for tax purposes. It

A second home can not only be practical for you, but also offer tax advantages – especially if you use a company car. But how exactly does this work and how can you best benefit from it? Find out everything you need to know here.

What does secondary residence mean for company cars?

A secondary residence is another residential address that you register alongside your main residence. It is often used by commuters who work in another city. If you have a company car, the second residence can be interesting for tax purposes, especially if you register it strategically.

In Germany, company cars are subject to the so-called 1% rule or the logbook method. Depending on the distance between your place of residence and your workplace, the taxable amounts can vary considerably. A second home near your workplace can reduce these costs.

How can you benefit from a second home?

- Shorter journeys to work: If you register your second home closer to your workplace, the tax-relevant distances are reduced. This means less non-cash benefit and therefore less tax.

- Optimizing the 1% rule: With a second home, you can minimize taxable private journeys and commutes. This is particularly helpful if you often commute between your main and second home.

- Professional flexibility: A second home offers you more flexibility for professional commitments. You not only save time, but also nerves, as you no longer have to travel long distances to work.

What should you look out for?

- Legal registration: A second home must be officially registered with the relevant registration office. Also check whether second home tax is due. This varies depending on the city.

- Clarity on the use of the company car: Make sure that the use of your company car is agreed with your employer and documented correctly for tax purposes.

- Consult a tax advisor: To get the maximum tax benefit from your second home and company car, it is advisable to consult a tax advisor. They can help you optimize all the details.

Tips for getting the most out of your second home

- Choose the right location: Your second home should be strategically located so that you can benefit from it both professionally and privately. Proximity to your workplace is crucial here.

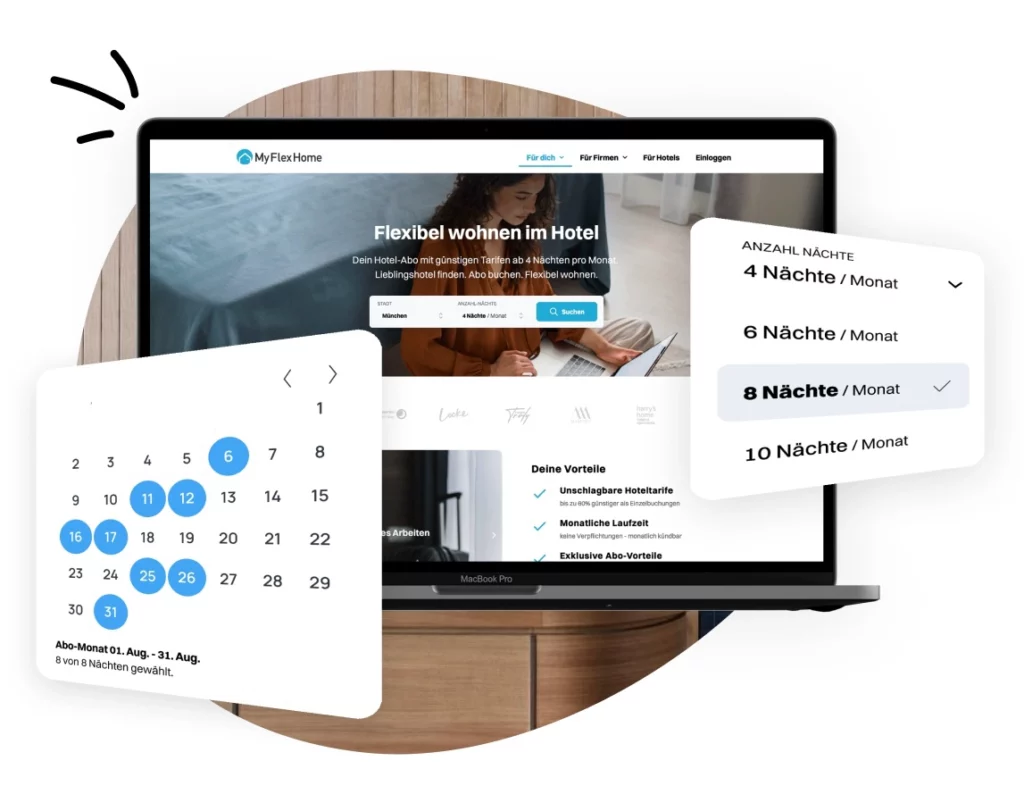

- Use flexible accommodation: A long-term rental contract is not always necessary. Flexible solutions such as hotel subscriptions – for example from MyFlexHome – offer you the opportunity to set up your second home without any major commitments.

- Think about your work-life balance: your second home should not only be practical, but also help you to improve your quality of life. Use the time you gain for hobbies or family.

Conclusion

A second home for your company car can bring you considerable advantages, both tax-wise and professionally. It is important that you inform yourself well and observe all legal requirements. With strategic planning, you can not only save taxes, but also gain time and quality of life. Use flexible solutions such as those from MyFlexHome to organize your second home in an uncomplicated and effective way. This way, you can make the most of your professional and private situation! Discover hotel subscription.

* MyFlexHome does not offer tax advice. All information is for general information purposes only and does not constitute tax, legal or financial advice. For individual advice, please consult a tax advisor or other qualified professional. MyFlexHome accepts no liability for decisions made on the basis of the information provided.