- Save tax with a hotel subscription*:

Use a hotel as a second home and save tax on your company car - Flexible secondary accommodation:

No long rental contracts thanks to flexible hotel subscription term – can be terminated monthly - Simplify your tax return*:

For the MyFlexHome hotel subscription, you receive an annual overview of all nights booked, which significantly simplifies your tax return

How to use a hotel subscription as a second home to save tax:

If you use a company car, the distance from your second home to your place of work is used for tax purposes. It

Company car and dual housekeeping

Taxing a company car is a complex matter, especially if you travel a lot for work and benefit from dual household management. But did you know that you can also claim a hotel as a second home? In this article, we’ll show you how to be clever about tax and what advantages MyFlexHome offers.

What is dual household management?

Double housekeeping allows professionals who maintain a second home for professional reasons to deduct certain costs for tax purposes. These include

- Accommodation costs (up to 1,000 euros per month)

- Travel costs between primary and secondary residence

- Additional expenses for meals in the first three months

Hotel instead of rental apartment: the flexible alternative

Using a hotel as a second home is an ideal solution for frequent travelers and commuters. The advantages:

- No long-term rental contracts: With a hotel you have maximum flexibility.

- Services included: Cleaning service, WLAN and often breakfast are included in the price.

- Simple billing: Invoices can be claimed directly for tax purposes.

Clever combination of company car and second home

If you use a company car, you should clearly document its use. The tax office differentiates between business and private journeys. However, in the case of dual household management, journeys between your primary and secondary residence can be deducted from tax. Using a hotel as a second home simplifies planning and helps to avoid unnecessary costs.

How can the company car be taxed?

The company car is usually taxed using the so-called 1% rule or the driver’s logbook:

- 1% rule:

- Every month, 1% of the gross list price of the company car is taxed as a non-cash benefit.

- In addition, 0.03% of the gross list price is charged per kilometer of distance between home and place of work.

- Driver’s logbook:

- All private and business trips are precisely documented here.

- This method is more complex, but can be cheaper if the private share is low.

It is important that you decide on a method and stick to it consistently. You should also keep all receipts and evidence carefully.

How MyFlexHome helps

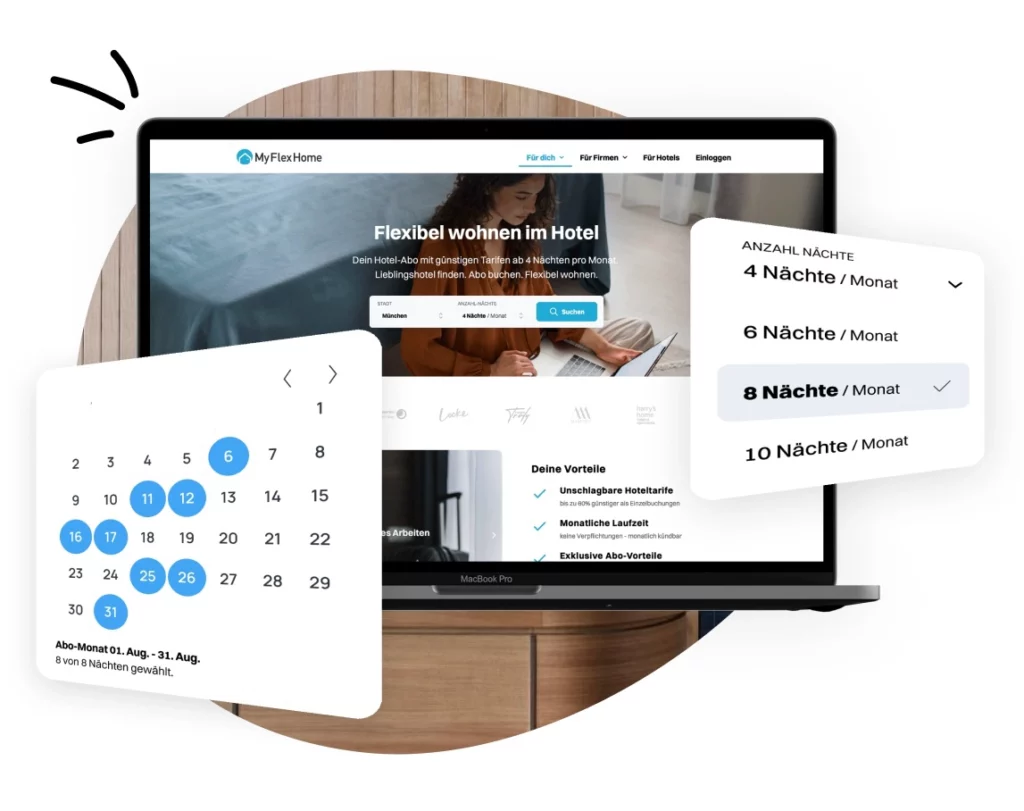

MyFlexHome offers flexible hotel subscriptions that are perfectly tailored to the needs of frequent travelers. With a fixed monthly allotment of nights, you can plan your stays in different cities – ideal for dual household management.

Advantages of MyFlexHome:

- Centrally located hotels

- Flexible booking changes

- Monthly cost control

Tips for tax assertion

- Keeping receipts: Keep all hotel bills in a safe place.

- Flat-rate mileage allowance: Use the flat-rate allowance for journeys between your primary and secondary residence.

- Expert advice: Consult a tax advisor to ensure that you exhaust all your options.

Conclusion

The combination of a hotel as a second home and a company car can offer tax advantages and at the same time give you maximum flexibility in your everyday working life. With MyFlexHome, you benefit from a well thought-out concept that is specially tailored to commuters and frequent travelers. Start today and experience a new way of traveling! Discover hotel subscription.

* MyFlexHome does not offer tax advice. All information is for general information purposes only and does not constitute tax, legal or financial advice. For individual advice, please consult a tax advisor or other qualified professional. MyFlexHome accepts no liability for decisions made on the basis of the information provided.